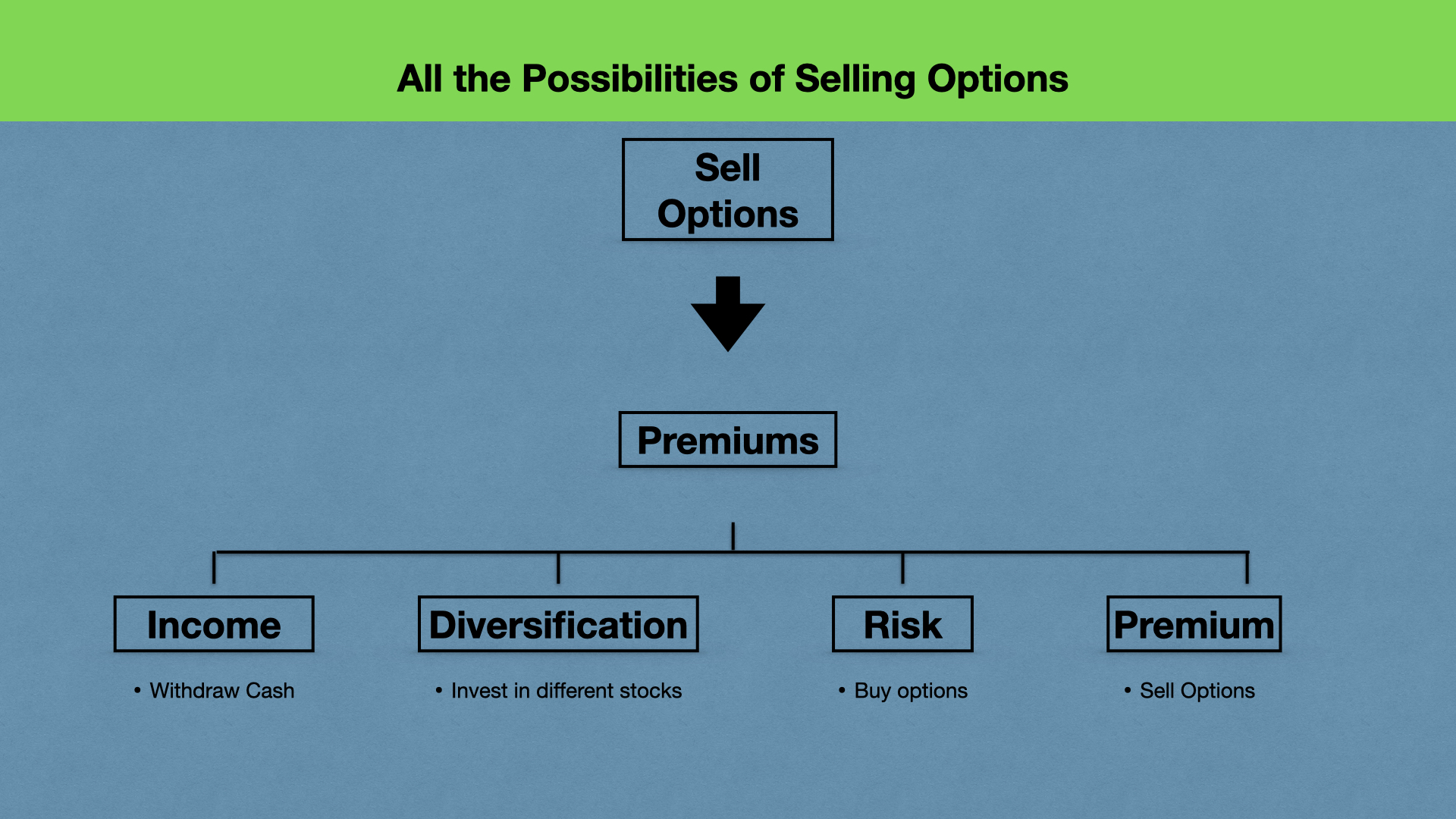

Hi Impatient Investors! In preparation for the Tiny Wheel Challenge starting December 1st, let’s revisit the wheel strategy and the possibilities of premiums. So in order to begin the wheel strategy we have to understanding selling options as they are the bread and butter of this strategy. To initiate the wheel strategy, to get the wheel in motion we have to sell a cash secured put. Selling a cash secured put puts aside the cash to secure the option just in case you are placed with the 100 shares. Whenever you are placed, you will have 100 shares of the underlying stock. So with this 100 shares, you can then sell a call and continue the strategy. Ideally, you would want to do this with stocks that will increase in price.

Premiums for Income

The most exciting of the possibilities of premiums is to be able to live off of the proceeds. Similar to investors that aim to live off dividends, investors can live off premiums. Selling options result in premium payments. Investors can essentially give themselves a weekly, bi weekly or monthly paycheck from selling options. Most options expire every Friday, therefore you have the ability to sell options for weekly income. This can be withdrawn on a weekly basis and be used for anything. Paying for bills or entertainment are all possibilities, the money is there to do anything with. It is within the realm of possibilities to gain 1% per week from the sales of option. For example a $100,000 portfolio could possibly yield $1000 a week. Essentially replacing the median US income of over 70,000 before taxes. However, in order to experience compounding in the stock market, reinvestment is necessary.

Premiums for Diversification

Premiums are really the whole point of this strategy. Gather the premiums weekly and use them for anything. The fact that these premiums can be used for anything makes it unique. You can choose different strategies depending on your risk tolerance. One of these strategies is for diversification. Use the premium from a high volatility stock to buy a low volatility. Use the premium from a growth stock to buy a dividend stock. To further diversify, premiums from one sector can be used to buy stocks in another sector. For example, use the premium received from selling an option on a healthcare stock to buy a tech stock. Also, if you treat cash like a position, the premiums would add to your cash stockpile.

Premiums for Risk

Selling options is a risk averse strategy. Selling a covered call protects against downside risk for your 100 shares and selling cash secured puts allows you to enter a position for a lower price. But what about the premiums from these stocks? This cash can be used in a riskier way than simply buying stocks or keeping the cash. You can use the premiums to buy options, which are considered more risky than selling options. Buying an option is risky because you can lose all the money you input, but with more risks come more reward. You can lose all of your money, but on the other hand, you can get 100% return. This is not to say that these are common scenarios but they are within the realm of possibility. However, this would be slightly less risky buying options with premium than your own inputted money.

Premiums for Premium

Selling options require a sizable amount of money, at least enough for 100 shares. Selling options involve 100 shares of stocks (selling covered call) or the money to buy 100 shares in selling cash secured put. For the premium received, if they are sizable enough, the money could be used to sell a cash secured put. This would add even more possibilities to gain premium.

Summary

The above mentioned strategies are all the possibilities of premiums. Premiums provide the cash for diversification, risk options, option premiums or for income. The weekly percentage return depends on the risk you are willing to take. With returns of 1% a week possible, selling options can be more rewarding than simply depending on dividends. Selling options can be a great addition to your investment strategy.

This is not investment advice.