Hi Impatient Investors

Adding to your portfolio can be expensive, but there are ways to add to your portfolio without adding any money. In order to understand this concept we have to understand dividend and DRIP. Let’s start with dividends, so dividends are recurring cash payments to share holders of a stock that pays dividends. As mentioned in “Easy Ways to Add Sources of Income“, dividends are essentially income, providing a major benefit to shareholders. Dividends are cash payments to your portfolio but you can have the dividend get reinvested into the same stock that offers the dividend, this is called DRIP.

DRIP

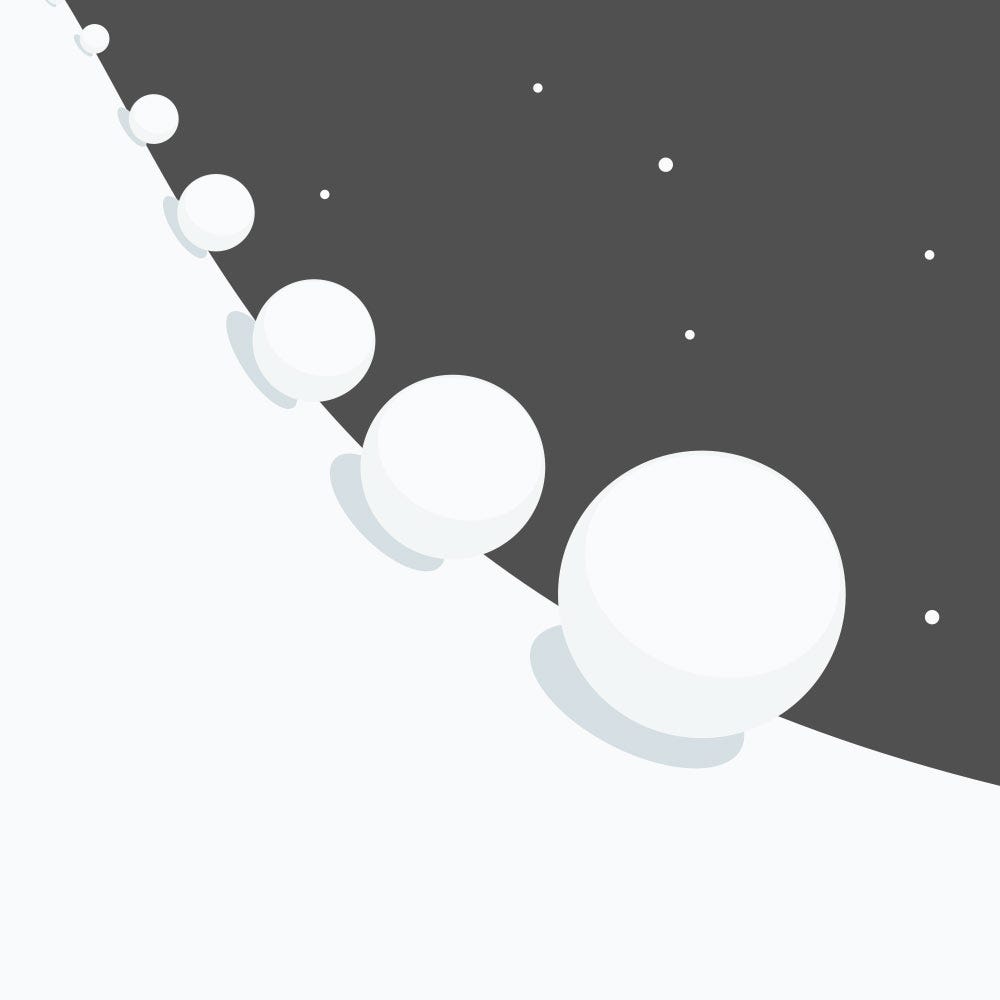

According to investopedia, “DRIP is a dividend reinvestment plan whereby cash dividends are reinvested to purchase more stock in the company.” DRIP represents compounding as the stock reinvests itself and in results in more dividend which results in more stocks which results in more dividends stock which result in more stocks. The point is, it gets larger over time and can get even more impressive as the dividend yield increases. Even further, there are stocks that increase in dividend on a yearly basis to even compound this effect greater. These stocks are called Dividend Kings or Dividend Aristocrats.

Dividend Kings

Dividend kings are stocks that have increased their dividends other the last 50 years. So they have a great a track record of increasing their payout to shareholders. Popular examples of these stocks are PG,KO, and JNJ. Dividend aristocrats have increased their dividends over the last 25 years, which is still very impressive, this list includes O, and MMM.

Adding Stocks to your Portfolio Without Adding Money

So the dividend reinvestment plan in addition to companies with growing dividends can lead to an impressive, compounding portfolio. Now let’s get specific, if you buy a certain amount of any dividend producing stock, it can add another share based on its dividend yield. So pick a stock, any stock to see how you can add an extra share. O (O Realty) for example pays over 6% per yield, each month it gives around 25 cents (0.25) and with a stock price of around $50, 200 shares would result in 1 extra share per month. So imagine, 200 shares turn into 201 then 2o2 then 203, and also add in the stock appreciating in price, it can get very exciting! Shares increase while dividend increases which results in more shares, thus more dividends.

KO Example

This is such an exciting example that we have to add another example. The example of KO, for those new to investing, KO is the ticker symbol for Coca Cola. The dividend yield is around 3.33%. Even quarter, it pays 46 cents (0.46) every April, July, October, December. At a stock price of around $56, you will need around 120 shares to earn an additional share per quarter. The stock can essentially take care of itself and compound over time. It has a history of dividend payouts that go over 50 years. It is a dividend king.

Consistently Add Money to your Portfolio

This is the second written attempt to help you add money to your portfolio without adding money. The examples above are of dividends, done in a way that compounds on itself. But, the first attempt was written in “How to Gain Weekly Income? Try Selling Options.” Selling options adds money to your portfolio through premiums and now dividends add money to your portfolio in regular payments.

Provide examples. Detail the drip method and the possibilities.